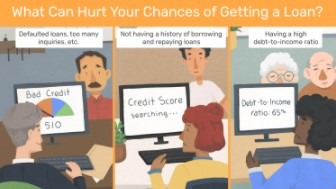

It’s important to shop around for the best home mortgage lenders for bad credit to get the best interest rates. While bad credit is a problem for many people, this doesn’t mean that you should settle for the lowest rates. It’s important to find several different lenders and compare their rates and terms before making a decision. There are many benefits to working with a mortgage broker, and they can also help you to avoid making mistakes that could cost you more money in the long run.

If you have bad credit, you can still get a mortgage. Although your credit is lower than others, you can still find a good lender for your loan. These lenders specialize in mortgages for people with poor credit. Their requirements are less stringent than those for normal mortgages, and they typically have lower down payments and interest rates. Some of these lenders also have special first-time buyer programs with relaxed credit requirements.

You can find mortgages for bad credit through many different types of lenders. There are government-backed loans, such as FHA or VA. Although these loans have stricter credit requirements than conventional mortgages, they are still a viable option for borrowers with bad credit. However, these loans usually have lower down payments than conventional loans. There are three main types of mortgage loans for people with bad credits. You can look for one that suits your situation and budget.

Home Mortgage Lenders For Bad Credit

Bad credit mortgage lenders fall into three categories. Regular mortgage lenders deal with FHA and VA loans, which have less stringent credit requirements than conventional mortgages. Small banks, on the other hand, may be able to work with more flexible credit guidelines. These lenders typically focus on serving the local community and economy. The more money you earn, the more you can borrow. It’s a good idea to talk with a banker if you have bad credit.

Because of the stricter credit requirements, home mortgage lenders for bad credit may offer lower interest rates than traditional lenders. These lenders will also offer more flexible terms than the average home mortgage. When shopping for home loans for bad-credit borrowers, make sure you shop around for the best mortgage rates. Remember that some lenders are better suited for people with bad credit than others, so make sure you shop around and find the best deal.

Home mortgage lenders for bad credit are a great option for people with poor credit. These loans are typically higher in interest than conventional mortgages, but the higher rates protect lenders against losses. Those who have bad-credit mortgage lenders should be willing to accept a lower interest rate than those with good-credit. If you are a low-income borrower, you should also consider working with a bank that does business with these types of loans.