With over 90% of homebuyers finding products and services through referrals, social media is an ideal way for mortgage brokers to get more leads. Not only can you increase brand awareness, but your posts can also help you build trust with your audience. Moreover, social media can boost your reputation in the mortgage industry. For more tips, check out APM’s Ultimate Guide to Facebook and Twitter Marketing for Mortgage Lenders.

The first step in developing an effective social media marketing strategy for your mortgage business is to create a content plan. This plan can help you curate content relevant to the audience and to build partnerships with other brands. This will ensure that your content is engaging and relevant to the borrowers. The next step in developing an effective social media strategy for your mortgage lender business is to identify the target audience and then decide on a strategy.

Consistency is an essential factor in social media marketing for mortgage lenders. You should post on a consistent basis, and keep your posts personal and informative. In addition, the frequency of your posts will depend on your resources and your team. If you are unsure of how often to post, you can refer to a benchmark report by Denim Social. Creating a content plan for your social media pages will help you create relevant content and boost your presence on the platform.

Social Media Marketing For Mortgage Lenders

You should also follow the right guidelines. Unlike advertising for consumer products, mortgage ads must meet certain requirements. For instance, Facebook requires mortgage lenders to create a Special Ad Audience (SAA) based on online behavior, but it is not discriminatory. Using a CRM designed specifically for the mortgage industry can help mortgage professionals ensure compliance. Surefire CRM provides features that allow you to approve messages before posting them and tracks posts for auditing purposes.

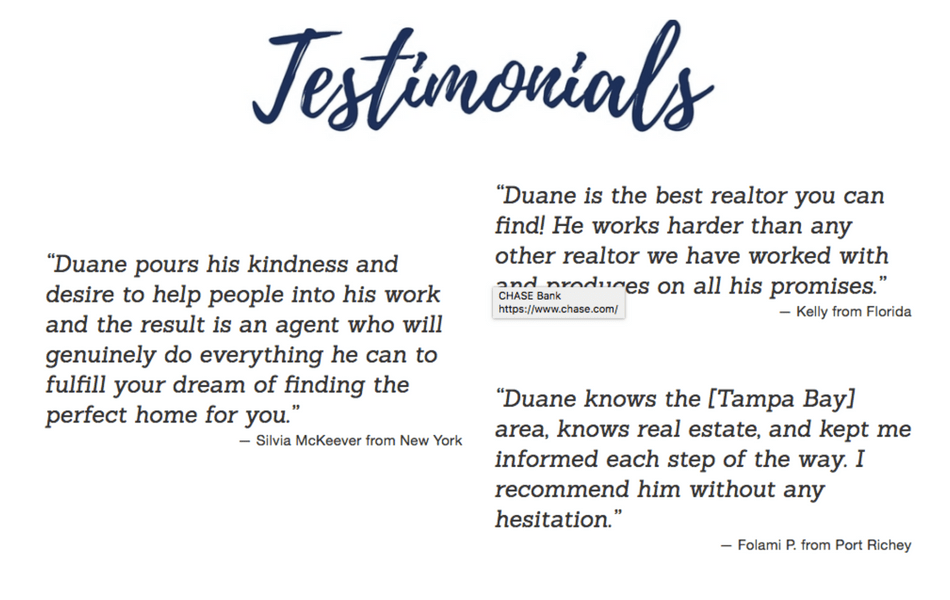

Your social media marketing strategy should include a human touch. People like to deal with real people and they are more likely to be satisfied with the outcome of their interactions. If you have a website, a profile page with relevant information is a must. You can also use Facebook to promote your business and share your content. For example, you can share pictures or videos from community events. These will make it more likely for your audience to remember you and your company.

As a mortgage broker, you wear many hats. Not every deal will go according to your plan. Using an automation platform for social media marketing will help you achieve consistency and brand awareness across all platforms. Moreover, you can pre-schedule your posts to avoid missing out on important posts. However, it is recommended that you have a clear content plan. After all, it is the content that will keep your clients and potential customers satisfied.

A social media marketing strategy for mortgage lenders should incorporate a human element. Most people prefer to deal with people instead of a business. As a result, a good social media strategy will not only make your presence known to potential clients, but also stay on top of the mind of real estate agents and potential clients. There are many benefits to using this type of online marketing for mortgage lending. This doesn’t require a huge investment.

When implementing social media marketing for mortgage lenders, it is essential to activate loan officers on the platform. Unlike brand pages, employee personal accounts have more reach than brand pages. Since these are your customers, they’ll be more likely to trust your posts if they come from a real person. The content plan should include a schedule of posts, as well as a schedule for content creation and management. As a result, the strategy will help you develop a consistent communication plan that can fit in with your busy work schedule.

Regardless of the channel you choose, your mortgage industry social media strategy should be consistent. This means that you’ll have to be consistent with your posts. Depending on the size of your team and your resources, you can post regularly or sparingly. But you should avoid posting about rates because it could end up discouraging your audience. If you’re not sure how to create a consistent social media strategy, check out Denim Social’s benchmark report.